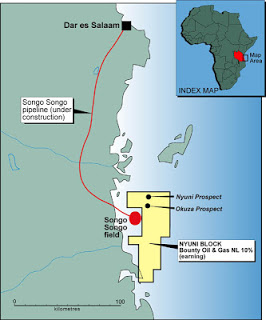

International oil giants are bearing down on East Africa. Off the coast of Tanzania, the discovery of 46.5 trillion cubic feet of natural gas reserves has put the country on the world energy map. The number is expected to rise to 200 trillion cubic feet in the next two years, and eventually transform Tanzania into a middle-income country.

Companies like Exxon Mobil, BG Group and Norway´s Statoil are working with the Tanzanian Petroleum Development Corp (TPDC) in exploration, building infrastructure and construction. However, the real issue is the profit-sharing contracts currently being negotiated between the big oil companies and the government.

The Production-Sharing Agreements (PSA) between the international firms and the TPDC are confidential. However, the draft of a contract with Statoil has leaked. Instead of the expected 50-75%, Tanzania would only be getting 30-50% of the “profit gas.” The government has little to no leverage but everyone knows the country needs the investment big oil could bring.

With elections coming up this year, the oil and gas question is a hot topic. For a politician trying to gain traction it is heaven-sent. From independence until his retirement in 1985 the country was lead by the great Julius Nyerere, whose ideology was socialist and has been called communist. The communitarian mindset lead to many great things and is still tangible in political discourses. However, it also lends itself to misuse.

The pre-election debate on the natural gas question for instance is full of flaming protectionist rhetoric. Here-comes-the-imperialist-west-again-we-must-protect-our-interests-so-vote-for-me-ism seems popular, especially with ruling party CCM. It simplifies things nicely, takes the attention away from failing schools and hospitals and reminds everybody that the problem is, really, external.

In this spirit parliament has just approved the Non-Citizens Employment Regulation Bill making it much harder for foreigners to work in the country. Partnership with various multinational oil giants will certainly see an increase in the number of foreign workers, never-mind the Chinese. Actually, do mind the Chinese, but somebody else can write about that. Ensuring that the ordinary worker gets a piece of the sloppy oil cake is very important, although it remains debatable whether this bill is the most effective way to go about it. One could argue that it discourages investment and that it forces companies to weasel their way around state legislation. Another problem is the lack of skilled workers, especially for managerial positions. Statoil has some great academic exchange and partnership programs, for instance with the University of Dar es Salaam, but is it enough?

Then there is the issue of corruption and lack of transparency. New money is flooding in, especially to the largest city, Dar es Salaam. Although some money ends up in the right hands and is used for the right things there is a definite partiality in Dar to making money vanish. Valiant efforts have and are being made to fight corruption, but corruption penetrates nearly ever aspect of society at all levels. The ecosystem of corruption is deep and old, very old, so old it should have its own museum, celebrating a long, creative and colorful history of soda-buying, palm-greasing and generally being up to something.

Will we see the oil and gas turn Dar into another Lagos? A widening gap between rich and poor could lead to a more divided society, higher crime rates and more violent crimes, even violent conflict. There has already been violence in the Southern Mtwara district over the building of a pipe-line to Dar es Salaam.

I think it is safe to say that for East Africa as a region, the development of the oil sector cannot be seen as only a blessing or only a curse. But over the coming years there will be some pretty rude changes to the region’s geo-politics in which the discoveries of oil and natural gas are a major factor.

The important thing for us mortals is not to loose interest and to continue to apply pressure on the various actors involved. For instance, if oil giants like Statoil are serious about supporting sustainable long-term development they must invest heavily and whole-heartedly in training and succession programs, and they must assist with strong legal support for the governments they are negotiating with, fair fight, fair play. Similarly, politicians who are serious about protecting national interest must think beyond party-interest and short-term political gain in the things that they say and the papers they sign. The situation warrants an appeal to the highest sense of public duty.

As observers, both in the global South and North, it is our job to engage ourselves in the processes, blow whistles and put pressure on decision-makers. What happens in the next few years will determine the fate of the region for at least the next fifty if not beyond.