WB urges Uganda to guard against volatile oil prices

The World Bank has asked governments of Uganda, Kenya and Tanzania to develop insurance measures to guard against fluctuating oil prices as they prepare to begin production.

The World Bank has asked governments of Uganda, Kenya and Tanzania to develop insurance measures to guard against fluctuating oil prices as they prepare to begin production.

Prices of oil and gas usually affect the cost of goods and services at both national and international markets.

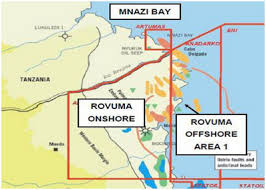

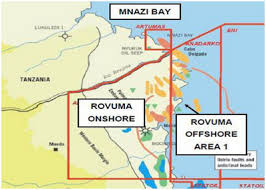

Uganda has both oil and gas deposits, Kenya has oil, while Tanzania has large deposits of gas and the three East African countries are preparing to begin producing for local and international markets.

Addressing participants at a regional conference on oil and gas in Entebbe recently, the World Bank Senior Economist Uganda country office, Dr Jean -Pascal Nganou, said oil and gas prices will always fluctuate and countries should be prepared to handle the consequences.

The conference was organised by Friedrich-Ebert-Stiftung.

He said in case of price dip by diversifying their by economies instead of aligning every development agenda to oil and gas revenue.

Also Read:7-ways-to-make-money-in-Tanzania-oil-and-natural-gas-industry

“Oil and gas prices will always fluctuate, consequently, oil and gas producers should develop by themselves and for themselves a good insurance mechanism against sudden drops in world prices,” Dr Nganou said.

He added: “Saving part of future oil revenue is the most adequate response to that type of problem. Several governments have opted for a variety of oil revenue saving mechanisms.

“Uganda, Tanzania and Kenya should review these mechanisms, analyse the results achieved, and make their own choices based on realistic assessment of their own situation, needs and risks.”

The World Bank produces periodic reports on world commodity price focus. In the latest report, the bank raises hope that there is going to be a pick-up in oil prices in the international market.

In this regard, Dr Nganou said: “Our commodity price specialists believe that the price of oil will rise again and most of the projections in Uganda are based on international crude oil price of $90 (Shs319,500) per barrel. We may be right, we may be wrong and this is one of the lessons for a good management of future oil revenue.”

Other challenges

Other than oil prices, East African countries are also faced with the problem of poor infrastructure, which affects the development of the private sector. The infrastructure includes power, roads, railways which East Africa must deal with to realise tangible development.

“Countries like Uganda, Kenya and Tanzania need to repair, and expand their economic infrastructure which at present is a major obstacle to private sector development,” the World Bank senior economist Uganda country office, Dr Jean -Pascal Nganou, said.

He said improved transport, power and water supply services are essential to stimulate urban and rural growth and improve the condition of the population.

The resident director Friedrich-Ebert-Stiftung, Ms Mareike Le Pelley, said oil and gas exploration is not an end in itself for the development process.

“The East African region has had high GDP growth rate but other social indicators like income distribution, unemployment and concept of inclusive development have not yet taken root in the region,” she said.