Top 3 Places On the Internet where Evey Tanzanian can Learn about Oil and Gas Sector for Free

I finally choose to write this article after getting requests from people who are eager to venture into oil and gas industry, but they lack prior knowledge of oil and gas industry.

Some of them are journalists who are very interesting to write about Tanzania oil and natural gas news and trend of oil and gas companies in Tanzania, but they don’t know how to go through it,

Some are entrepreneurs they want to invest into oil and gas industry, but the don’t have basic information on oil and gas industry.

The fact is that you not invest in the business you don’t know and is the reasons for this investor they want to have a basic knowledge of oil and gas industry

So the article explains the online platform everyone can learn about oil and gas industry.

If you are students or oil and gas professionals and you want to learn new things you will love this article, if a reader you don’t have basic knowledge on oil and gas industry, then you are about to learn great stuff

3 online opportunities every Tanzanian can learn about oil and natural gas industry

Recent days internet has facilitated everything, you can learn anything you have to know by simply on a single click of your computer mouse.

Let face them

1:OpenOil.com

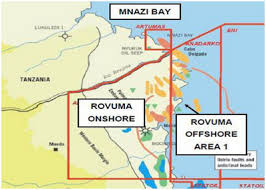

Through this online platform, you can learn the history of Tanzania oil and natural gas industry, oil and gas companies operating in Tanzania, areas of oil and gas production in Tanzania,

Also, you can understand the government and private companies that are involving directly in the oil and gas industry in Tanzania.

You will have better understanding on function of Tanzania petroleum development co-operation (TPDC), oil and gas exploration activities in Tanzania and you will learn about petroleum act and local content policy of oil and gas sector in Tanzania

To start learning follow this link http://wiki.openoil.net/index.php?title=Tanzania_Oil_and_Gas_Almanac

2: The biggest oil and gas knowledge community(Oges.Info)

This is the largest oil and gas community which involve oil and gas experts with enough knowledge and experience in oil and gas industry all over the world.

These people they have already worked with various oils and gas companies across the world.

Also you meet with graduates and other students worldwide, through this site you allowed to ask anything then oil and gas expert will answer your question.

You will learn a lot from oil production, oil and gas drilling, oil and gas project management health and safety etc. Your job now is to visit this site and join this bank oil and gas knowledge. To check out all resources on this website visit http://www.oges.info/

Also Read:Interesting-business-opportunities-in-tanzania-oil-and-natural-gas-sectors-for-local-entrepreneurs

3:Alison

Is online learning platform founded 2007 by Mike Fereek, a serial entrepreneur? Since 2007, more than 350,000 people graduated from its free certificate and diploma courses.

For Tanzanians, this is the perfect place to find out a lot of stuff for oil and gas industry.

The sad reality is that quality and standard of oil and education in most east African countries including Tanzania are a terrible situation, most people and curriculum are often outdated, not meet the demand of petroleum industry.

That is why foreign entrepreneurs and investors use this challenge to make money, you will be amazed on how foreign companies they swarm to Tanzania to invest oil and gas curriculum development

To check out oil and gas available on Alisona follow this link https://alison.com/search/result/?q=oil+and+gas

Final words

If you have read this article, I congratulate you!

But procrastination is the killer of dreams, don’t say I will start later, you’re the right time to begin to learn new things are now. Oil and gas industry is no guarantee for those who unwilling to learn new things.

Dear reader we love to hear all of these from you: