Time is now to invest in oil and gas sector

The low price of oil has dashed initial hopes for oil and gas investment in Africa, but governments have the opportunity to turn things around.

The low price of oil has dashed initial hopes for oil and gas investment in Africa, but governments have the opportunity to turn things around.

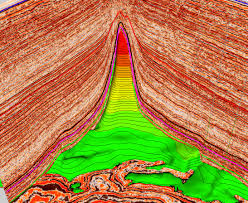

The discovery of oil off the coast of Ghana in 2007 – and subsequent hydrocarbon finds in Uganda, Kenya, Tanzania and Mozambique – sparked an exuberant international response, with oil and gas investors initially flocking to what many saw as a new frontier for the industry.

The excitement was understandable as the oil and gas finds in Mozambique had the potential to increase the country’s GDP five-fold by 2040. Ghana’s economy, too, was being transformed. Prices were booming and the ‘Africa Rising’ narrative was taking hold with rising consumption and improved political stability changing investor perceptions.

Eight years on, with oil price halved to below $50 a barrel, the enthusiasm looks a little optimistic.

While there have been significant successes in oil and gas exploration, the overall pace of investment still lags behind.

The cost of infrastructure and evolving local regulation often makes for a more uncertain investment in Africa, compared to markets which have been operating for decades.

Rules requiring the inclusion of local companies and workers in oil and gas supply chains are positive for long-term economic development, but mean more upfront investment in the transfer of knowledge and skills.

Meanwhile, Africa’s ‘above ground’ risks, such as political complexity, insecurity, fiscal instability and regulatory change, are often higher than those found in markets with an established oil and gas sector.

Taxation and regulatory frameworks take time to establish in ‘new’ oil markets, and as such, can potentially be seen as a risk. When oil prices are high, and capital abundant, investors are able to balance these risks with potential returns. However, at lowered prices, investors look for lower-risk markets – another factor stacked against Africa.

Currently, we are seeing evidence of investment flows being pulled back towards North America, as the competition for capital within the oil and sector becomes more acute.

Meanwhile, as investors chase safe returns, Africa’s oil has to compete for dollars with other sectors of the economy, such as the fast growing consumer market and technology sectors. As a result, the oil and gas sector lacks capital at a time when, ironically, investment capital has never been so available.

The current low oil price is an opportunity for Africa to review the relationship between host governments and investors – and for, African governments need to make investment opportunities as conducive as possible.

When prices were at $100 a barrel, some governments ran the risk of being lulled into a false sense of security, assuming they had the upper hand in negotiating inward investment.

Today, however, with lower prices and competitive investment alternatives, we are seeing an increased level of pragmatism on the part of some governments and policy makers. Public sector leaders and influencers are beginning to understand the importance for projects to go ahead, and go ahead as soon as possible.

Experience is everything. Having seen both the peaks and troughs of oil prices, African governments are more likely now to introduce investment-friendly policies, regulations and incentives, which could to boost the growth potential of the oil and gas sector.

Through my various conversations with governments across Africa, I am encouraged by a growing understanding of the need to create a more collaborative and investment-friendly environment.

This is the fourth oil price slump I have witnessed in my career. The timing of the recovery is unclear, but when it does happen, and the dust settles, the winners will be those countries that were able to attract investment despite the downturn. The losers will be those inflexible destinations who stuck to the old rules.

Africa can use this time to secure itself a position among the winners by creating a robust investment environment, avoiding the ‘feast and famine’ scenario that all too often accompanies oil price cycles.