The Role of LNG in Reshaping the Future of Tanzania

By Mohamed Mahgoub

Natural gas is a reliable energy source used globally to meet growing energy demands. With increased natural gas consumption over the past few years, Liquefied Natural Gas (LNG) have become a significant component of urban infrastructure.

Tanzania has started exploring for oil and gas over the last 64 years, and they have the first discovery in 1974 in Songo Songo Island and Minari Gulf. After four years of delay, Tanzania will start the Offshore LNG project in the Lindi area in Southeastern Tanzania. Tanzania continues developing its reserves from offshore natural gas, estimated to be 57.54 TCF and 49.5 TCF away from the coast, referred to as the Specified Energy Platform.

The final investment decision (FID) of the long-awaited liquefied natural gas(LNG)project is expected in 2025, with the front-end engineering and design (FEED) phase preceding FID. The LNG will be developed in the Lindi, south of the country.

Construction time will likely be five to six years, suggesting the large-scale project could come on-stream around 2030.

This LNG project shall also secure more jobs for Tanzanian national capacities. It is not an economic perspective but is the social one as well in how to improve the lifestyle of the Tanzanian people from such supergiant projects.

Tanzania shall consider making such a supergiant project as the inspiration of the Tanzanians that their land is the land of the treasures and attractive for global investment.

I expect Tanzania to develop the education curriculum to seize the opportunity of such a super giant national project, more geoscientists, reservoir, production engineers, and more specialization in the LNG industry.

Send Tanzanian oil and gas specialists in cross-posting with Shell and Equinor companies in their HQ to develop the career ladders of the national capacities.

It is also writhed to admit artificial intelligence applications in the LNG as an upswing industry trend in oil and gas.

Why could Tanzanians not mimic Shell and Equinor as the future African operator to establish such LNG industries with the rest of African countries? Another dimension for investing in such an extraordinary project shall be used as an analog.

Before starting the project by Shell and Equinor, Major Oil and Gas companies globally, it is also imperative to conduct due diligence before the project begins.

Due diligence is a common term for investigating and analyzing a business or organization before a transaction is completed. That due diligence such as financial, legal, operational, and tax due diligence shall be implemented that assure the success of this big national project.

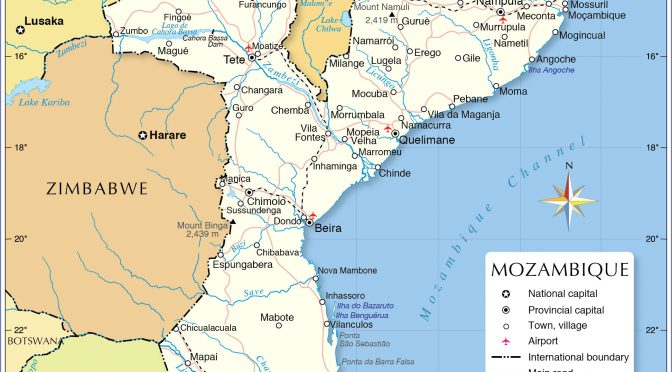

Shareholders seek their interests and a lot of money from such LNG projects. Now EU is focusing on natural gas liquefaction (LNG) from Gabon, Tanzania, and Mozambique; therefore, Africa is feeling such an uptick and will provide 220 billion cubic meters of natural gas in 2040.

Europe’s interest in African oil and gas in its plan to diversify the suppliers away from the Russian supplier as a consequence of the Russian-Ukrainian war. African LNG will continue to increase in the rest of 2023 and in the coming years.