Why it’s important for Oil companies to do reservoir modelling and simulation? PART 2

By

RENATUS MAHUYU

Msc Oil and NaturalGas Engineering

China UNIVERSITY OF GEOSCIENCES-WUHAN CHINA.

Phone number /WhatsApp: +8613006172786

www.renatusmahuyu.blogspot.com

From our previous article, we discussed about how geologists go about when finding oil and gas in the exploration stage.

Read: Why It’s Important For Oil Companies To do Reservoir Modeling and Simulation( Part1)

In this article, we will discuss;

- The life cycle of an oil field,

- The meaning of reservoir modelling and simulation,

- Data used to construct reservoir models,

- Reservoir engineering software’s for modelling and simulation

The life cycle of an oil field

There five phases in the life cycle of an oil field, they include;

- Exploration/Discovery Phase

In this phase, thegeologists and geophysicists main activity is to search and locate the hydrocarbons beneath the earth’s surface using seismic surveys. Once the geologists and geophysicists agree on the existence of hydrocarbons in a particular area, exploration wells are drill to confirm. Exploration wells are typically not very deep

- Appraisal Phase

Successful exploration drilling of oil or gas leads exploration companies to go for next stage which is appraisal phase.

This phase focuses on reducing uncertainty about the quantity and qualities of the discoverable oil and gas reserve and its properties.

During appraisal, more wells are drilled to collect information and samples from the reservoir. Another seismic survey might also be acquired in order to better the image of the reservoir.

The activities take several years and cost around $10 to $100 million.

Upon successful completion of this stage, companies can then move to the next stage of development.

- Development Planning

The development stage takes place after successful appraisal and before full-scale production. It is done for the following reasons;

- To form a plan on how many wells need to be drilled to produce the oil or gas (geologists, geophysicists and reservoir engineers)

- To decide the best design for the production wells (drilling engineers)

- To decide what production facilities are required to process the oil/gas before it is sent to a refinery or customer (facilities engineers)

- To decide what the best export route might be for the oil and gas (logistics engineers)

- Production Phase

This is the process of extracting the hydrocarbons. The primary activity conducted during this phase is pumping hydrocarbons to the surface. Sometimes, more wells may be drilled within the development area to enhance hydrocarbon recovery. Once the fluid starts flowing, it must be separated into its components (oil, gas, and water). Other activities that occur during production phase include production enhancement, well servicing (routine maintenance such as replacing worn or malfunctioning equipment), and well workover (a more extensive equipment repair). The production phase may last for a number of decades. During this phase, wells and associated facilities are routinely monitored.

- Abandonment/Cessation of Production(CoP)

When production wells no longer economically produce enough oil, the wells are plugged and the site restored by dismantling facilities such as platforms, putting the wells in a safe state, preserving the field’s residual hydrocarbon reserves of the field, and cleaning, depolluting and rehabilitating the site.

What does Reservoir modelling and Simulation mean?

Let us first define the meaning of the key terms: reservoir, reservoir modelling, simulation and reservoir simulationin the petroleum field

Reservoir; a porous medium that contains (Oil/Gas) hydrocarbons.

Simulation; a process of imitating or mimicking an actual or assumed real world conditions over time, for the purpose of forecasting performance of the system by the use of a created model

Reservoir simulation;a process of predicting future reservoir performance and finding ways andmeans of optimizing hydrocarbon recovery under various operatingconditions.

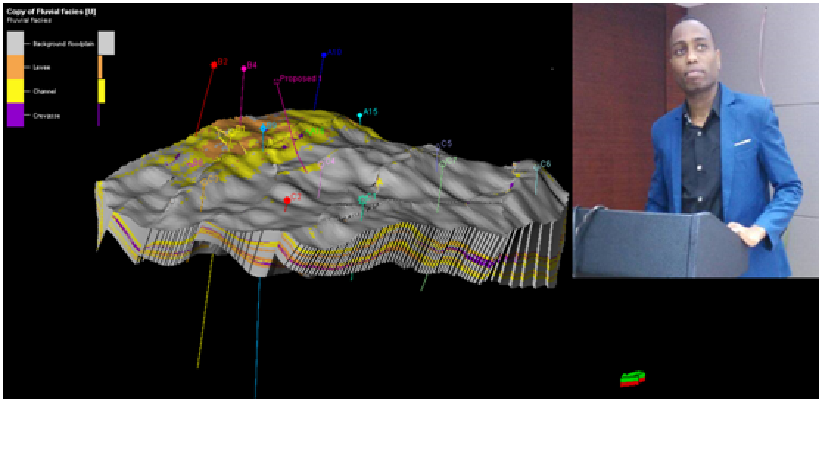

“A reservoir model represents the physical space of the reservoir by an array of discrete cells, delineated by a grid which may be regular or irregular. The array of cells is usually three-dimensional, although 1D and 2D models are sometimes used.”

Reservoir models are divided into two categories:

- Geological models are created by geologists and geophysicists and aim to provide a static description of the reservoir, prior to production.

- Reservoir simulation models are created by reservoir engineers as dynamic models which show or simulate fluids flow within the reservoir over time.

RESERVOIR MODELLING AND SIMULATION STAGES

| DATA | Geology study | Reservoir simulation (Dynamic Model) | |||

| Well data, well tops

Geo-Physic(Seismic)

|

Reservoir, Geometry correction | Sensitivity Analysis | |||

| Drilling (Cutting) | Fault modeling | Static model | History matching | ||

| Petro-Physic(well logs data)

Core Fluid sample (surface-Bottom Hole) |

Zonation | Prediction | |||

| Lithological modeling | |||||

| Scenario definition | |||||

| Economic Analysis | |||||

| Property modeling | |||||

| Reservoir Management |

Reservoir Engineering Software for Modelling and Simulation.

There a lot of commercial software used by Geologist and Reservoir engineers in modelling and simulation process.

Software’s

- ECLIPSE Schlumberger

- Petre software

- INTERSECT

- ExcSim

- Computer Modelling Group LTD -CMG software

- SKUA-GOCAD High Resolution Reservoir Modelling

The uses of these software and its advantages.

- To do numerical simulation, from black oil and compositional to thermal recovery of heavy oil resources.

- creating 3-D reservoir model.

- To provide uncertainty quantification, field management, history matching

- To reduce risk, maximize recovery of oil and gas reserves as well as enhance field economics.

- Maximize the value of your well tests with optimized designs that honor the geological model

For those who need to practice and learn/practically on how to use this software you can communicate with us THROUGH CONTACT PROVIDED.

Next Discussion will be on How a reservoir model is Constructed and Why modelling and simulation

Thank you

For further enquire, questions and suggestion please feel free to contact me through provided contacts