The Petroleum Act 2015, the Tanzania Extractive Industry (Transparency and Accountability) Act 2015, and the Oil and Gas Revenues Management Act 2015 are conceivably the most controversial in recent years, given the sweeping reforms these pieces of legislation seek to bring to the Tanzanian petroleum industry, which is projected to be the single largest contributor to the national economy.

Passed under certificate of urgency before the end of the 20th session of the National Assembly last July, these Acts have just been assented to by President Jakaya Mrisho Kikwete on 4th August 2015. The Acts, it is hoped by the Government of Tanzania (GoT), will update and consolidate existing enactments for the petroleum industry.

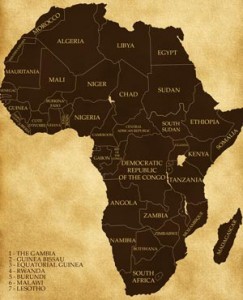

The introduction and passing of the Acts can be traced to the emergency of competing petroleum investment opportunities in other sub-Saharan African countries, most notably Kenya, Uganda, Egypt, Algeria, Ghana, Nigeria, Angola, and Mozambique; and, according to press reports, the fear of losing investors to these countries.

At the outset, it should be pointed out that building accountability and trust by increasing openness and transparency in administering and managing the petroleum industry cannot be overstated. As such, the Tanzania Extractive Industry (Transparency and Accountability) Act 2015 will be largely viewed as positive by all stakeholders.

It appears, however, that the effectiveness of the Tanzania Extractive Industry (Transparency and Accountability) Act 2015 is watered down by the provision which requires the publication of all concessions, contracts and licences relating to the extractive industries, including oil and gas. Non-compliance is a criminal offence, which attracts a stiffer pecuniary fine of Tshs.150 million (approximately, US$75,000) for companies.

This provision is expected to become a bone of contention between the GoT and international oil and gas investors, since it’s not clear if all the signed Production Sharing Agreements (PSAs) will need to be published, considering the confidentiality clauses contained in the PSAs and MDAs. It will be interesting to see how the provision will be actually applied.

For purposes of restructuring the country’s petroleum institutional framework, the new legislation establishes and, in some instances, re-establishes the following authorities, institutions, and funds: l Oil and Gas Bureau – This is an independent department, under the Office of the President, mandated to advise the Cabinet on strategic and commercial aspects of the country’s oil and gas economy.

Petroleum industry regulators – A new regulatory authority, the Petroleum Upstream Regulatory Authority (PURA), will oversee the upstream petroleum sub-sector and perform audits of the cost recovery on the exploration, development, production and sale of oil and gas in order to determine government profit share and royalties (rents). Already well-known by industry stakeholders, the Energy, Water and Utilities Regulatory Authority (EWURA) is re-established but with a new role: regulatory oversight over the midstream and downstream petroleum subsector.

Tanzania Extractive Industry (Transparency and Accountability) Committee – This is an autonomous body responsible for promoting and enhancing transparency and accountability and ensuring that the benefits of the extractive industries are verified, duly accounted for, and prudently utilised for the advantage of Tanzanians.

The National Oil Company (NOC) – The Tanzania Petroleum Development Corporation (TPDC) is designated as the NOC and will exclusively manage the GoT’s commercial interests and involvement in petroleum projects. TPDC will participate in petroleum reconnaissance, aggregate natural gas, own and operate major gas infrastructure either directly or via subsidiaries, and collect and account for non-tax oil and gas revenues, surface rentals and block fees.

Two funds are proposed for the industry – The Oil and Gas Fund, established under the Oil and Gas Revenues Management Act 2015, will be responsible for maintaining fiscal and macroeconomic stability, enhancing social and economic development, and safeguarding resources for future generations. A Decommissioning Fund is also established under the Petroleum Act 2015, and international oil and gas investors will need to factor payments to this fund into their costs.

Besides restructuring the institutional framework, the new legislation seeks to re-organise the regulatory framework for the petroleum industry. Accordingly, PURA, responsible for regulating the upstream petroleum sub-sector, will oversee the processing, granting, renewal, suspension and cancellation of exploration, development and production licences for the NOC (TPDC); implement local content programmes; facilitate the resolution of complaints and disputes; and deal with other issues relating to the management of petroleum areas, private sector entity partnerships with TPDC, and reservation of blocks for TPDC.

In that regard, a registry of petroleum agreements, licenses, permit authorisations and any change in interest of an existing petroleum agreement, license or permit will be established and maintained by PURA.

International oil and gas investors should be aware that any purported transfer or assignment of an interest which is not authorized by the Minister of Energy and Minerals is in vain.

Additionally, investors should note that, as the NOC, TPDC will be given the first right of refusal to acquire a participating interest intended to be transferred or assigned to a non-affiliate.

A domestic gas supply obligation is imposed on license holders to satisfy the domestic market in Tanzania from their proportional share of production, but how this will actually operate remains imprecise.

This obligation, which is directed towards improving Tanzania’s perennially poor power system and assisting local industrialisation, will be considered by most Tanzanians as deserving of praise.

For the midstream and downstream petroleum subsector, EWURA will have similar regulatory oversight roles like PURA: issuing, renewing, suspending, and cancelling construction approvals and operational licenses; collecting fees and levies in accordance with the EWURA Act; approving applications for tariffs and prices; promoting the use of local goods and services; and ensuring the maximum participation of Tanzanians in every part of the petroleum value chain.

Using the National Petroleum and Gas Information System (NPGIS), a strategic planning tool, EWURA is, under the Petroleum Act 2015, mandated to let the public know, periodically, about the status of the industry.

A key part of the NPGIS will be the Central Registry of Petroleum Operations (CRPO). TPDC will designate one of its subsidiaries to exclusively purchase, collect and sell natural gas from producers.

The subsidiary, called the aggregator, will be licensed by EWURA. This implies that international oil and gas investors may not have the need to set up separate legal entities for marketing and distribution purposes.

Moreover, these investors must give serious consideration to how they will interact with the aggregator. As mentioned previously, TPDC has exclusive rights over petroleum in the upstream sub-sector, but it does not have such rights in the midstream and downstream sub-sector.

So, international oil and gas investors can find processing, transportation and storage; liquefaction, shipping and re-gasification; and distribution opportunities in the midstream and downstream sub-sector, without concluding partnership arrangements with TPDC.

Tariffs for transportation and distribution of gas are set by EWURA, however, concerns about the viability of petroleum operations in Tanzania means that international oil and gas investors will be expecting EWURA to consult them in setting tariffs.

In discharging their regulatory responsibilities, PURA and EWURA are to act in accordance with the Tanzania Development Vision 2025, the Energy Policy 2003, the Natural Gas Policy 2013 and a yet-to-be finalized Local Content Policy.

Locally produced goods and services are required to be given first consideration by a license holder, and where such goods and services are unavailable, the same are to be provided by a foreign company which has a joint venture arrangement with a Tanzanian company.

The objective here, it is understood, is to help improve the competitiveness of Tanzanians in the global marketplace by giving them access to advanced technology and management experience when they work in consortia with foreign companies.

It is obvious that petroleum projects require access to land. Under the Petroleum Act 2015, TPDC is considered as the only entity which will have land rights and facilities in the upstream sub-sector.

The President is empowered to grant a right of occupancy over land to a license holder, assumed to be TPDC; however, where the corporate vehicle is a joint venture between TPDC and a foreign entity as the majority shareholder, there may be issues with respect to foreign ownership of land, which is prohibited under the land laws of Tanzania.

In such a scenario, in order to obtain rights over land for upstream petroleum activities, a key question is whether the joint venture with TPDC would have to be registered under the Tanzania Investment Centre (TIC)?

From a fiscal perspective, the main objective of international oil and gas companies and the GoT investing in or permitting operations in the petroleum industry is to derive revenue. That’s why changes and developments in the Tanzanian tax regime are important.

Very briefly, the Petroleum Act 2015 makes provision for payment of annual licence fees and bonuses to TPDC (upon on signing of the relevant agreement and on commencement of production) as well as all other relevant taxes, including capital gains tax in respect of a corporate reorganization and withholding tax on interest payments of loans.

BY Paul Kibuuka, is the Managing Partner of Kibuuka Law Chambers.