Back in 2016, I was in the office of one of the independent oil-and-gas exploration and production companies in East Africa.

As I presented my services, the manager asked whether I can help them with recruitment of a local slick line/wire line engineer with 10 years’ work experience.

Although I was not a recruiter, I could never afford to reject the opportunity to save the manager and his team cost, trouble and months to find the perfect candidate to fill the position.

The manager sent me the details and requirements of the worker they needed. I went out to find the perfect candidate to fill the vacancy.

I reached out to numerous workers in my cycle of contacts and database. I created an advert and posted on the internet and social media networks. I spent tons of hours hunting for whom to fill the single position.

I received resumes from over 100 applicants, both local and international candidates.

But I could never find the qualified person with requisite expertise and experience to fill the position.

Although some of the international applicants had the skills and experience needed to fill the position, they weren’t target audiences. The organization wanted to hire a local worker and not an expatriate.

I felt overwhelmed and frustrated.

So out of 100 applicants, I picked the resumes of the 30 local applicants that I thought might be the perfect candidates for the vacancy and submitted them to the manager.

My favorite e-mail came from the manager. He said not one was qualified.

Why Good People Can’t Get Oil and Gas Jobs: The skills Shortage and What Oil and Gas Companies can do About It

From that experience, some questions popped into my head. Why can’t brilliant and talented people get great jobs in the oil and gas industry even when these jobs clearly exists and needed to be filled? And what can be done about this?

Why do companies need months of hunting to fill a mid-level single vacancy? What are the root causes for the skills shortage across the industry?

Training Shortage and Not Skills Shortage

As I dug to the root of the problem, I heard some people complaining about lack of academic skills and technical capability among jobs applicants.

Furthermore, the course content doesn’t meet the oil-and-gas industry expectation.

There are those who complain about lack of work experience. Now permit me to look deep into each of these complaints.

It is totally untrue to claim that the deficiency in academic and technical capability is why good people can’t get job or is the main cause of skills shortage.

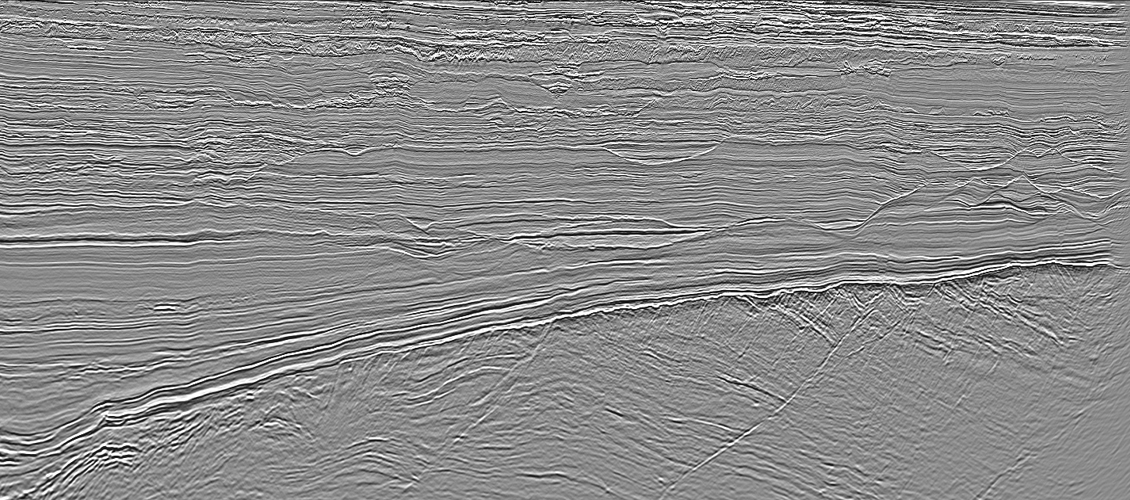

In the oil-and-gas business, you have to know things before you do them. Prospective workers have a college degree or ordinary diploma in an oil-and-gas related curriculum. So, they have basic knowledge and understanding of the industry.

On the other hand, lack of experience isn’t a reason for skills shortage across the industry. Because nobody can get experience in college. That’s where training comes in. And the goods new is that most of the oil-and-gas skills are largely learned on job.

The important reason bright people can’t get job across the industry is because employers want a field-ready candidate.

They want workers to start contributing right away without any further training program or ram up time. So, these days to get jobs you need to be job-ready.

This narrows the supply of competent people in the industry.

The pressure to stay competitive in today’s business world has led many organization to demand more from their existing workers and they will do same from their future employees.

And to cope with the oil price volatility, many companies have put internal training development into the list of things to downsize. In today’s economy, employers want new personnel to start contributing with no further training. But people who can do that are those who have partially done the same job before.

Significant Impacts to Oil and Gas Companies

But the skills shortage has significant negative impact on the oil-and-gas companies’ shareholders. Skills shortage increase high employment costs. It also declines productivity because you have to spend months to fill mid-level positions, which in turn lowers productivity, decrease profitability and finally create bad stock. And everyone loses.

Make Training and Development Payoff for The Oil and Gas Employers

As you have just seen, individuals are partially responsible for the skills shortage in the industry.

But the problem is likely linked to the inability of weak employers to promote internal training and development companies.

So if the cost is stumbling block to invest in training and development, how do we make training programs pay off for the industry? How do you address skills shortage?

That’s where I can help.

If you ask me how you can address skills shortage in East Africa’s oil-and-gas industry and what you can do to raise the competitiveness of the sector to become world class and internationally competitive, my answer would be pretty simple:

Encourage all oil companies to promote internal training and development programs and make these training programs pay off to them. No more than such…

Encouraging collaboration between universities and oil-and-gas employers has become a little bit frustrating because employers don’t see immediate pay-off with these kinds of arrangement.

The solution isn’t to push problems to regional universities, and colleges aren’t only the option.

Placing huge emphasis on the regional universities and let them off courses content that meet the need of the oil and gas employers. It is also not only the strategy.

What can be done about this?

In-house Training: Running in-house training programs is the best option for many employers because it beats the cost of importing expensive experts into the country and it saves companies time in hunting and filling the vacancies in the organizations.

If you can’t fill leadership positions in your organizations, why don’t you set up in-house training programs to create your own managers?

If you can’t fill production manager positions, why don’t you set up in-house training programs to create your own productions managers?

Are you wondering how you can fill reservoir engineering positions? Run in-house training programs to create your own reservoir engineers.

That’s the way to address skills shortage. That is the perfect solution to moving local capacities from just users to world-class professionals and industry leaders.

That’s the way to boost productivity engagement and improve performance. That is how you propel the East African oil-and-gas workforce competence to become world-class and internationally competitive for the benefits of business communities and countries.