Southern Africa oil & gas market 2015-2025

/28 Comments/in News/by Hussein BoffuVisiongain has calculated that the Southern African oil and gas market will see capex of $18.55bn in 2015, including spending on both upstream exploration & development (E&D) and midstream infrastructure.

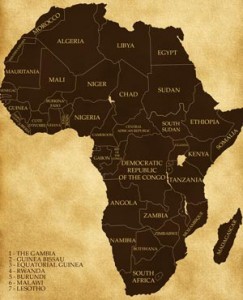

Southern Africa is the single largest region of Africa, a region that includes a diverse range of economies all at varying stages in terms of oil and gas industry development. OPEC member Angola and newcomer Namibia on the West coast are set to increase oil and gas production over the coming years with the continuing exploitation of pre-salt reserves. Mozambique and Tanzania are set to rapidly increase gas production to cater for burgeoning domestic and regional demand for gas-to-power facilities, as well as a desire to supply the resource-hungry economies of Southern Asia via LNG exports. South Africa is looking to expand its offshore operations, boosted by successes off its Western coast, as well as hoping to expand onshore shale gas development in the Karoo Basin to supply the needs of the region’s economies. Lastly, Madagascar is set to become one of the world’s most exciting emerging oil producers, and is currently vying for foreign capital along with other countries in the region to develop its large onshore, heavy oil and oil sands reserves over the coming decade.

The report will answer questions such as:

• What are the prospects for upstream oil and gas markets in Southern Africa?

• What are the prospects for midstream oil and gas markets in Southern Africa?

• How are oil prices affecting the Southern African oil and gas market?

• Who are the leading companies in Southern Africa?

• Which Southern African countries are currently attracting the most upstream and midstream spending and how will this change over the coming decade?

How will you benefit from this report?

• Over 280 pages of analysis, including 153 charts and tables, which provide the perfect accompaniment to high-end business presentations

• Details on upstream exploration and development activity across 226 active license blocks in the region

• Information on 24 current and future midstream projects

• Up-to-date oil price forecasting and analysis

• Sections on Economy and Energy Sector Development by country

• Sections on Political Risk Analysis by country

• In-depth interviews with industry experts, providing exclusive insights into oil and gas developments across the region

Five reasons why you must order and read this report today:

1. The report provides forecasts and analyses for the main categories of oil and gas upstream and midstream spending in Southern Africa

Upstream

– Geophysical studies

– 2D studies

– 3D studies

– Onshore wells

– Offshore wells and subsea development

– Floating Production Systems (FPS)

Midstream

– Pipelines

– LNG facilities

– GTL facilities

– Refineries

– Storage

2. The above upstream & midstream submarkets and spending categories are broken down for the six largest national markets in Southern Africa

– Angola

– Madagascar

– Mozambique

– Namibia

– South Africa

– Tanzania

– ‘Rest of Southern Africa’ (Botswana, Lesotho, Swaziland, Zambia and Zimbabwe)

3. Tables and analysis detailing the latest activity within each Southern African licence block

4. The analysis is also underpinned by our exclusive interviews with leading experts:

– James Baban, Managing Director of Tanzania Ltd

– Dr David Mestres Ridge, CEO of Swala Energy

5. Comprehensive accompanying analysis on each country:

– Economy and Energy Sector Development

– Political Risk Analysis

Who should read this report?

– Companies currently investing in, or thinking of investing in, any Southern African countries

– Anyone within the upstream and midstream oil and gas industry

– CEOs

– COOs

– CIOs

– Business development managers

– Marketing managers

– Suppliers

– Investors

– Contractors

– Government agencies

– Onshore/offshore drilling engineers

– Geologists

Don’t miss out

This report is essential reading for you or anyone in the upstream and midstream oil and gas sector in Southern Africa. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there.

For more information, please visit : https://www.visiongain.com

Tanzania: Gas Discoveries Spark Dreams of Making Tanzania New Hot Spot

/26 Comments/in News/by Hussein BoffuWILL recent natural gas discoveries help Tanzania become an economic powerhouse? The answer to this question isn’t quite simple. The gas and oil wealth will require a commitment from all the country’s stakeholders.

For a decade the government, along with international companies involved in hydrocarbons prospecting, has made a series of announcements of natural gas discoveries. These announcements have given rise to much excitement; ordinary Tanzanians are hoping for improvements in their living conditions, while the government is looking forward to billions of dollars in export revenues and foreign direct investment (FDI).

Government departments involved in the gas sector have made repeated statements of their intention to use these funds for national development. Along with this commitment the government has taken steps to improve the regulatory environment for hydrocarbons, including gas, through a review of its laws. It also commissioned a Natural Gas Master Plan for Tanzania that will outline scenarios for utilisation of the resource once production starts. Early indications are that the government is considering two options for the gas.

The first is to sell all of it in liquefied form on the international market, and the second is to use a portion of the resource for domestic gas-based industries, and export the rest. A key policy question is how to optimise the balance between the two, to meet the twin objectives of economic growth and sustainable development. The argument for general development of the gas sector hinges on the belief that it will bring in foreign revenues, create jobs and boost economic growth.

The government considers that these benefits will in turn contribute to poverty alleviation, one of Tanzania’s key priorities. Although the logic of this is understandable, given the country’s low socio-economic status, experience in many resource-rich African countries points to the fact that natural resource wealth does not per se translate into economic and human improvement.

You can also read:Tanzania extracting of gas in the Indian ocean likely to take longer

Countries such as Nigeria, Sierra Leone and the Democratic Republic of Congo, which have abundant natural resources, have been less than successful in using their endowments to make the transition from low-tomiddle- income economies, or to reach acceptable developmental indices. Pitfalls attending resource extraction have been widely documented.

The phenomenon of resource abundance existing alongside poor economic indicators, also known as the ‘resource curse’, threatens to overshadow the hopes and possibilities that come with large resource discoveries. A range of challenges associated with resource discoveries and booms has been widely ventilated.

There is a convergence of opinion that sound economic policy and law-making, a political will and governmental commitment to development, and good and transparent governance of the gas and oil sector, can do much to ensure that the exploitation of petroleum resources leads to broader economic and social development in the face of challenges that in the case of Tanzania among others include poverty, poor access to energy, limited infrastructure, unemployment and an unskilled workforce.

In the past two decades gas has emerged as a major component in the global energy mix. It is increasingly seen as an attractive fossil fuel alternative to crude oil and coal, because it is cleaner burning than either and sufficiently versatile to be used as direct domestic and industrial heating and power generation; as a direct fuel source for vehicles; and as industrial feedstock for liquid fuels and other chemical products. According to the International Energy Agency (IEA), natural gas is ‘poised to enter a golden age’.

A significant proportion of the coming gas boom will be from unconventional resources such as shale gas and coal-bed methane, provided that the social and environmental impacts associated with their extraction can be ameliorated. By 2035 gas will overtake coal as a primary energy source, to comprise 28 per cent of the global energy mix – second only to crude oil.

Similarly, it has been argued that ‘gas is the only fossil fuel set to increase its share of energy demand in the years to come’. Whereas the gas boom relies primarily on unconventional gas, conventional gas resources such as those in southern Tanzania certainly have a role to play. Currently, successive discoveries of conventional and unconventional gas resources suggest a revolution in the global energy industry may be at hand.

What this will mean for governments and national economic development depends on the governance mechanisms and management systems put in place to ensure that the resource is transformed into tangible social benefit. Whether the government will be able to keep to its objective of using gas for development, either through revenues from exports or the creation of domestic gas based industries or a combination of both, largely depends on the way in which the sector is governed.

It is too early to state with any certainty that the exploitation of this finite resource will benefit the majority of Tanzanians. Given the adoption and implementation of sound governance policies, however, together with competent and transparent administrative processes, effective, functional and independent oversight institutions and a commitment to directing profits towards socio-economic development, Tanzania can go some way to avoid the resource curse and its consequences while advancing its stated developmental goals.

Tanzania gained independence from Britain in 1961. Since then the country has been governed by Chama Cha Mapinduzi. Tanzania has had a multi-party democratic political system since 1992 and held four rounds of general elections between 1995 and 2010 . Tanzania’s economy includes services sectors (taking in transport), some manufacturing, fisheries and agriculture.

Donor aid is the single biggest contributor to the national budget. The contribution of extractive industries to the fiscal budget is, however, growing rapidly. In recent years the country has emerged as a resource haven. In addition to rich deposits of coal and natural gas Tanzania has significant deposits of heavy mineral sands; limestone; bauxite; rare earths; graphite; gold and base minerals, among others. Depending upon how they are managed, such natural resources could lift Tanzania into middle-income status.

Gas has been discovered in the southern region of Mtwara. Resource extraction necessarily has an impact on the environment and for that reason achieving complete environmental balance and harmony is to all intents and purposes impossible, nevertheless all activities should aim to limit any environmental degradation that might result. This approach is already addressed in law and in environmental impact assessments: maintaining environmental integrity should not be sidelined as the resource revenues threshold draws nearer and the stakes get higher.

The government should try to allay such fears through a genuine commitment to further developing these sectors, not only because they are activities that traditionally have supported livelihoods but also because of the risks inherent in over-reliance on exports of a single natural resource commodity. Gas and liquefied natural gas production will become a dominant revenue generator in Tanzania.

The massive investment followed by the infrastructure boom will transform the southern Tanzanian provinces, allowing the local governments to get involved. Tanzanians expect that this will facilitate and attract the entry of foreign investors, exploring not only the opportunities in the energy sector, but also other areas, such as chemical, power, manufacturing and mining.

Solo Oil has Welcomed the decision of Tpdc to back Into Kiliwani North

/24 Comments/in Career Advice, News/by Hussein BoffuSolo Oil has welcomed the decision of the Tanzania Petroleum Development Corporation to back into the Kiliwani North Development Licence for a 5% working interest as a fully paying partner.

The assignment of the interest to TPDC will be subject to it paying the existing joint venture partnership the 5% pro-rata share of the development capital spent to date and to complying with the existing joint operating agreement.

Once the back-in is concluded Solo’s interest in the KNDL will be 6.175% (current interest 6.5%).

Solo chairman Neil Ritson said: “Solo is delighted that TPDC have chosen to exercise their back-in rights which will further increase their alignment with the partnership developing Kiliwani North.

“We continue to anticipate reaching final agreement on the gas sales agreement shortly and gas sales revenues commencing soon after.”

You can also read:Solo oil ranks Tanzania assets highest

The KNDL contains the Kiliwani North 1 well, which the company expects to produce at up to approximately 30 million feet per day of gas (gross). Once producing this will represent a major milestone for Solo, providing the company’s first revenues from its investments in Tanzania.

A gas sales agreement, with appropriate payment guarantee provisions, is pending signature and once signed will allow gas to flow from the KNDL to the newly constructed Songo Songo Island gas processing facilities and into the national pipeline to customers in Dar es Salaam.

Solo holds an option to increase its interest in the KNDL by 6.5% to a total of 13% once the gas sales agreement is signed for a further payment of $3.5 million to Aminex. This option will also be subject to TPDC back-in once concluded. Solo would then hold a 12.35% working interest in the licence.

Participants in the Kiliwani North Development Licence are currently: Ndovu Resources Ltd (Aminex) 58.5% (operator), RAK Gas LLC 25%, Solo Oil plc 6.5% and Bounty Oil & Gas 10%.

Delayed Tanzanian Permit Limit Asker Oil&Gas Company

/27 Comments/in News/by Hussein Boffu

DAR ES SALAAM, Tanzania – Norway’s Aker Solutions, an oil and gas services company, is concerned at the Tanzania government delays in issuing relevant permits writes JOSEPH BURITE.

“Even though the market has been very volatile, we see that Africa still has a lot of big mega projects for field development. It’s driving our strategy,” Egil Boyum, the Senior Vice President for Operations and Business Improvement said recently.

He was speaking on the sidelines of a Norwegian business forum in the Tanzanian commercial capital, Dar es Salaam.

“When you talk to the people here on gas, I think it’s not about the market. It’s more a question about getting predictability into their plans,” Boyum said.

He said: “Both in Mozambique and Tanzania, operators are talking about the process of getting licenses, agreements with partners and governments is what is taking time and dragging out. To me, that’s a bigger risk to them than the commodity market.”

You can also read:Tanzania extracting of natural gas in the Indian ocean likely to take longer

He said Aker’s partners, Statoil (Norwegian state oil company) and BG (a British multinationa gas firm) are yet to get land and permits in Tanzania, which has hindered their planning, according to Boyum.

“It’s easy to understand that politicians here (Tanzania) are more careful because it’s a very important asset with a 20 to 30 year lifetime and we need to do it right, but also the volatility in the market means it’s smart for them to move. Don’t take too long,” he said.

Tor Smestad, Aker’s Vice President for Strategy and Business Development, said: “Things were moving a little bit faster in 2013 and early 2014, but now Mozambique has moved maybe two years ahead of Tanzania,”

“For us we see East Africa getting more and more interesting and we expect within less than a year there will be real field developments taking place in Mozambique,” Boyum said.

This month Tanzanians will vote in General Elections for a new president and parliament.

Tanzania:Extracting of Natural Gas In the Indian Ocean Likely to Take Longer

/25 Comments/in News/by Hussein Boffu

Hopes of extracting liquefied natural gas (LNG) in the Indian Ocean have been dashed after officials implementing the multibillion-dollar project discovered an underwater canyon that is likely to cause delays.

Why Investors Should Be Ready for New Petrol Regime

/27 Comments/in News/by Hussein Boffu

The Petroleum Act 2015, the Tanzania Extractive Industry (Transparency and Accountability) Act 2015, and the Oil and Gas Revenues Management Act 2015 are conceivably the most controversial in recent years, given the sweeping reforms these pieces of legislation seek to bring to the Tanzanian petroleum industry, which is projected to be the single largest contributor to the national economy.

Passed under certificate of urgency before the end of the 20th session of the National Assembly last July, these Acts have just been assented to by President Jakaya Mrisho Kikwete on 4th August 2015. The Acts, it is hoped by the Government of Tanzania (GoT), will update and consolidate existing enactments for the petroleum industry.

The introduction and passing of the Acts can be traced to the emergency of competing petroleum investment opportunities in other sub-Saharan African countries, most notably Kenya, Uganda, Egypt, Algeria, Ghana, Nigeria, Angola, and Mozambique; and, according to press reports, the fear of losing investors to these countries.

At the outset, it should be pointed out that building accountability and trust by increasing openness and transparency in administering and managing the petroleum industry cannot be overstated. As such, the Tanzania Extractive Industry (Transparency and Accountability) Act 2015 will be largely viewed as positive by all stakeholders.

It appears, however, that the effectiveness of the Tanzania Extractive Industry (Transparency and Accountability) Act 2015 is watered down by the provision which requires the publication of all concessions, contracts and licences relating to the extractive industries, including oil and gas. Non-compliance is a criminal offence, which attracts a stiffer pecuniary fine of Tshs.150 million (approximately, US$75,000) for companies.

This provision is expected to become a bone of contention between the GoT and international oil and gas investors, since it’s not clear if all the signed Production Sharing Agreements (PSAs) will need to be published, considering the confidentiality clauses contained in the PSAs and MDAs. It will be interesting to see how the provision will be actually applied.

For purposes of restructuring the country’s petroleum institutional framework, the new legislation establishes and, in some instances, re-establishes the following authorities, institutions, and funds: l Oil and Gas Bureau – This is an independent department, under the Office of the President, mandated to advise the Cabinet on strategic and commercial aspects of the country’s oil and gas economy.

Petroleum industry regulators – A new regulatory authority, the Petroleum Upstream Regulatory Authority (PURA), will oversee the upstream petroleum sub-sector and perform audits of the cost recovery on the exploration, development, production and sale of oil and gas in order to determine government profit share and royalties (rents). Already well-known by industry stakeholders, the Energy, Water and Utilities Regulatory Authority (EWURA) is re-established but with a new role: regulatory oversight over the midstream and downstream petroleum subsector.

Tanzania Extractive Industry (Transparency and Accountability) Committee – This is an autonomous body responsible for promoting and enhancing transparency and accountability and ensuring that the benefits of the extractive industries are verified, duly accounted for, and prudently utilised for the advantage of Tanzanians.

The National Oil Company (NOC) – The Tanzania Petroleum Development Corporation (TPDC) is designated as the NOC and will exclusively manage the GoT’s commercial interests and involvement in petroleum projects. TPDC will participate in petroleum reconnaissance, aggregate natural gas, own and operate major gas infrastructure either directly or via subsidiaries, and collect and account for non-tax oil and gas revenues, surface rentals and block fees.

Two funds are proposed for the industry – The Oil and Gas Fund, established under the Oil and Gas Revenues Management Act 2015, will be responsible for maintaining fiscal and macroeconomic stability, enhancing social and economic development, and safeguarding resources for future generations. A Decommissioning Fund is also established under the Petroleum Act 2015, and international oil and gas investors will need to factor payments to this fund into their costs.

Besides restructuring the institutional framework, the new legislation seeks to re-organise the regulatory framework for the petroleum industry. Accordingly, PURA, responsible for regulating the upstream petroleum sub-sector, will oversee the processing, granting, renewal, suspension and cancellation of exploration, development and production licences for the NOC (TPDC); implement local content programmes; facilitate the resolution of complaints and disputes; and deal with other issues relating to the management of petroleum areas, private sector entity partnerships with TPDC, and reservation of blocks for TPDC.

In that regard, a registry of petroleum agreements, licenses, permit authorisations and any change in interest of an existing petroleum agreement, license or permit will be established and maintained by PURA.

International oil and gas investors should be aware that any purported transfer or assignment of an interest which is not authorized by the Minister of Energy and Minerals is in vain.

Additionally, investors should note that, as the NOC, TPDC will be given the first right of refusal to acquire a participating interest intended to be transferred or assigned to a non-affiliate.

A domestic gas supply obligation is imposed on license holders to satisfy the domestic market in Tanzania from their proportional share of production, but how this will actually operate remains imprecise.

This obligation, which is directed towards improving Tanzania’s perennially poor power system and assisting local industrialisation, will be considered by most Tanzanians as deserving of praise.

For the midstream and downstream petroleum subsector, EWURA will have similar regulatory oversight roles like PURA: issuing, renewing, suspending, and cancelling construction approvals and operational licenses; collecting fees and levies in accordance with the EWURA Act; approving applications for tariffs and prices; promoting the use of local goods and services; and ensuring the maximum participation of Tanzanians in every part of the petroleum value chain.

Using the National Petroleum and Gas Information System (NPGIS), a strategic planning tool, EWURA is, under the Petroleum Act 2015, mandated to let the public know, periodically, about the status of the industry.

A key part of the NPGIS will be the Central Registry of Petroleum Operations (CRPO). TPDC will designate one of its subsidiaries to exclusively purchase, collect and sell natural gas from producers.

The subsidiary, called the aggregator, will be licensed by EWURA. This implies that international oil and gas investors may not have the need to set up separate legal entities for marketing and distribution purposes.

Moreover, these investors must give serious consideration to how they will interact with the aggregator. As mentioned previously, TPDC has exclusive rights over petroleum in the upstream sub-sector, but it does not have such rights in the midstream and downstream sub-sector.

So, international oil and gas investors can find processing, transportation and storage; liquefaction, shipping and re-gasification; and distribution opportunities in the midstream and downstream sub-sector, without concluding partnership arrangements with TPDC.

Tariffs for transportation and distribution of gas are set by EWURA, however, concerns about the viability of petroleum operations in Tanzania means that international oil and gas investors will be expecting EWURA to consult them in setting tariffs.

In discharging their regulatory responsibilities, PURA and EWURA are to act in accordance with the Tanzania Development Vision 2025, the Energy Policy 2003, the Natural Gas Policy 2013 and a yet-to-be finalized Local Content Policy.

Locally produced goods and services are required to be given first consideration by a license holder, and where such goods and services are unavailable, the same are to be provided by a foreign company which has a joint venture arrangement with a Tanzanian company.

The objective here, it is understood, is to help improve the competitiveness of Tanzanians in the global marketplace by giving them access to advanced technology and management experience when they work in consortia with foreign companies.

It is obvious that petroleum projects require access to land. Under the Petroleum Act 2015, TPDC is considered as the only entity which will have land rights and facilities in the upstream sub-sector.

The President is empowered to grant a right of occupancy over land to a license holder, assumed to be TPDC; however, where the corporate vehicle is a joint venture between TPDC and a foreign entity as the majority shareholder, there may be issues with respect to foreign ownership of land, which is prohibited under the land laws of Tanzania.

In such a scenario, in order to obtain rights over land for upstream petroleum activities, a key question is whether the joint venture with TPDC would have to be registered under the Tanzania Investment Centre (TIC)?

From a fiscal perspective, the main objective of international oil and gas companies and the GoT investing in or permitting operations in the petroleum industry is to derive revenue. That’s why changes and developments in the Tanzanian tax regime are important.

Very briefly, the Petroleum Act 2015 makes provision for payment of annual licence fees and bonuses to TPDC (upon on signing of the relevant agreement and on commencement of production) as well as all other relevant taxes, including capital gains tax in respect of a corporate reorganization and withholding tax on interest payments of loans.

BY Paul Kibuuka, is the Managing Partner of Kibuuka Law Chambers.

Top share picks for Q4

/25 Comments/in News/by Hussein Boffu

With the third quarter of 2015 being the worst three-month period for global stockmarkets in four years, investors will hope the first day of October rings in a more profitable fourth. Just to make sure, one broker has been tinkering with its portfolio, bringing in some interesting growth plays and ditching one of Britain’s best-known blue chips.

Despite outperforming the market by 9.2% in the quarter to September, Panmure Gordon admits that the performance of its ‘Conviction List’ portfolio is “hardly a great result” against a market that fell 9.1%. As investors processed the impact of the slowing Chinese economy, the MSCI Global Index fell 11.2% in the period. Analyst Jeremy Grime also points to “a couple of true mistakes” in the commodities sector.

However, it wasn’t all doom and gloom, with some relief found in the Federal Reserve leaving interest rates unchanged – Panmure expects a December hike – and solid growth in the UK, US and Eurozone setting the world economy up for nearly 3% growth this year. And although the portfolio didn’t break any trends in the last quarter, it has outperformed the Datastream UK market index by 114% since 2010, with a capital return of 147%.

With potential upside of nearly 20%, it’s little wonder the analysts have added Berkshire-based software technology company Micro Focus (MCRO) to their fourth quarter Conviction List at 1,200p. Panmure reckons the group, which is a member of Interactive Investor’s Summer Portfolio, could be worth 1,438p if it implements greater divisional transparency and its Amsterdam conference in October goes well.

In 2014, total revenue nearly doubled to $834.5 million at constant currency, and, although adjusted cash profit beat expectations with an 86% leap to $357.6 million, pre-tax profit fell 38% to $91.4 million due to the purchase of US software rival The Attachmate Group. “The current ratings are a c33% discount to the sector, and do not give the company any credit for its continued strong operational performance, nor cash returns – we expect those next year,” says Panmure. Buy.

Explorer with 60% upside

Joining Micro Focus in the portfolio is pub chain Greene King (GNK) and Tanzania-based oil and gas explorerWentworth Resources (WRL). With a target price of 50p, the analysts reckon Wentworth has over 60% upside. Valuing Greene King at 1,015p, the pub chain’s shares could be worth an extra 30%.

Panmure’s portfolio doesn’t just contain long positions. Betting on the likelihood that the following shares could plummet, it has added engineer Rolls-Royce (RR.) and booze chain Majestic Wine (MJW) to its short holdings. At 651p, Panmure reckons Rolls is worth 16% less at 520p, while the wine merchant is overvalued by about 14%.

Just four days into his tenure as boss of Rolls, Warren East issued his first profits warning at the iconic engineer. We warned recently that things could be about to get a lot worse as trading conditions continue to deteriorate and commodities continue to suffer, especially after the further sharp depreciation of emerging market currencies. Clearly, Panmure has the same thinking.

The broker ejects more companies than it lets in this quarter, with the low oil price blamed for two exits –Anglo American (AAL) and Faroe Petroleum (FPM). With global turmoil and cheap oil wiping the shares out, Anglo has crashed by 39% and Faroe by a quarter. “We got it wrong,” confesses the analyst.

Also leaving its long-holding portfolio are travel agent Thomas Cook (TCG), hi-fi manufacturer Focusrite (TUNE) and recruiter Robert Walters (RWA), all of which are “stale”. After Thomas Cook failed to deliver the upgrades investors were pining for, a sell-off leaves the stock trading 15% lower in the three months to June 2015. With no earnings upgrades, Focusrite’s shares have drifted down 6% and Robert Walters has struggled against a declining market and the shares are flat.

Closing its short position on Fenner (FENR) and Morgan Advanced (MGAM) after a fall of 20% and 12.4% respectively, the broker wants to crystallise its profits as the shares near their target price.

With 17 stocks now in its portfolio, Panmure has long positions on Allergy Therapeutics (AGY) (Buy, TP 47p),Chemring (CHG) (Buy, TP 294p), GLI Finance (GLIF) (Buy, TP 71p), Greene King (GNK) (Buy, TP 1,015p),Hammerson (HMSO) (Buy, TP 825p), Hansard Global (HSD) (Buy, TP 120p), Imperial Tobacco (IMT) (Buy, TP 3,730p), Informa (INF) (Buy, TP 650p), Micro Focus (Buy, TP 1,438p), RPC Group (RPC) (Buy, TP 828p),Ryanair (RYA) (Buy, TP€16.5), Shaftesbury (SHB) (Buy, TP 1,106p) and Wentworth Resources (Buy, TP 48p), with short positions on Majestic Wine (Sell, TP 320p) and Rolls-Royce (Sell, TP 520p).

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Mining, oil threaten most of Africa’s natural heritage sites – group

/49 Comments/in News/by Hussein Boffu

London – Mining, oil and gas exploration poses a threat to 61% of Africa’s Unesco-approved Natural World Heritage Sites and nearly one-third of sites worldwide, the World Wildlife Fund (WWF) conservation group said on Thursday.

London – Mining, oil and gas exploration poses a threat to 61% of Africa’s Unesco-approved Natural World Heritage Sites and nearly one-third of sites worldwide, the World Wildlife Fund (WWF) conservation group said on Thursday.

“Our research shows that intrusion into natural World Heritage Sites is especially high in Africa, where 61% of these precious areas are subject to some form of extractive concession or activity,” WWF said in a report.

The report found that extraction concessions or activity affect 25 of Africa’s 41 World Heritage sites.

Worldwide, 70 of 229, or 31%, of natural World Heritage Sites are under threat, it said.

“We are going to the ends of the earth in pursuit of more resources,” said David Nussbaum, chief executive of WWF in Britain, adding that minerals, oil and gas “are becoming more difficult and more expensive to extract.”

The report urges investors to help safeguard natural sites by ensuring “responsible conduct” by the companies in which they invest.

WWF’s findings flagged Tanzania’s 50 000km2Selous game reserve, a World Heritage Site since 1982 that “covers an area larger than Denmark and is one of the few remaining examples in Africa of a relatively uninhabited and undisturbed natural area.”

But legislation passed in 2009 allowed licensing of mineral extraction inside Tanzania’s game reserves.

Since then, five active mines, more than 50 mining concessions and six oil and gas concessions have sprung up that “could potentially impact the Selous game reserve,” according to the report.

“The reserve was added to the World Heritage danger list in 2014 in part due to concerns regarding extractive activities within the reserve,” it said.

License Round Announcements and Updates At The 22nd Africa Oil Week 2015, Cape Town

/in News/by Hussein BoffuCAPE TOWN, SOUTH AFRICA, October 1, 2015 EINPresswire.com/ — Global Pacific & Partners will host the 22nd Africa Oil Week/Africa Upstream Conference 2015, in JV partnership with ITE Group plc, 26th– 30th October, in Cape Town, South Africa.

This meeting commands unique global reputation as the most important in or on Africa, with 120+ Speakers, 150 + Exhibitors, 40+ Governments – and with over 30+ African National Oil Companies, plus official licensing agencies, and over 1,000+ key senior oil and gas industry executives and state oil officials from across or involved in Africa, currently confirmed to attend.

The Africa Oil Week is trusted worldwide as the only global venue for “one-stop” Licensing Round Announcements, Government Roadshows, and Corporate Showcase – along with rich-content and quality senior executive attendees providing direct opportunity for acreage and asset transactions, deal-making, networking, corporate partnership, new venture initiation, and high-level government relations.

Congo License Round 2016: HE Jean-Marc Thystere Tchicaya, Ministre des Hydrocarbures de la République du Congo supported by PGS, will make a keynote presentation and open the 2016 Licence Round and will host the Congo Roadshow during the Africa Oil Week with Ministerial, DGH and SNPC Delegations in attendance, and supported by PGS.

Gabon License Round Announcement: HE Etienne Dieudonne Ngoubou, Minister of Petroleum and Hydrocarbons, Gabon will be announcing the Gabon Deepwater License Round 2016. The Minister will be at the 22nd Africa Oil Week, with the Government Delegation in attendance, supported by CGG.

Ghana: The Petroleum Commission, Ghana joins as a Sponsor of the 22nd Africa Oil Week 2015. Theo Ahwireng, Chief Executive Officer, Petroleum Commission, Ghana will be present with a Ghanian delegation and the Commission will exhibit.

INP: Carlos Zacarais, Chairman, Instituto Nacional do Petroleo (INP), Mocambique, is confirmed to present at the 22nd Africa Oil Week, with an INP delegation present and also participating in the exhibition.

Kenya: The Ministry of Energy, Kenya, will be in attendance to present plans for future licensing.

Morocco: Onhym will be presenting and has confirmed presence at the Exhibition

New Sponsors: PetroSA, Vinson & Elkins, Wood Group, PSN

New Exhibitors: MGGS, Transnet National Ports Authority, Government of Alberta (Canada), CBH, CapMarine, GAMA Industrial Plants, Red Sea Housing Services, Horizon Geosciences, Stormgeo, RSI Geophysical, Vinson & Elkins, Ethiopia, McDermott, Geospace, Sonangol*, Bell Geospace, Cameron, ONHYM, Friburge Oil & Gas

The 22nd Africa Oil Week encompasses: the 13th Africa Independents Forum, 17th Scramble for Africa Strategy Briefing (Presentations by Dr Duncan Clarke, Chairman, Global Pacific & Partners) and 71st PetroAfricanus Dinner In Africa with social networking occasions, breakfasts, luncheons, dinners, and cocktail receptions.

Government & Country Presentations and Participation includes: Equatorial Guinea with Minister, Gabon with Minister and Ministry Delegation, Ghana, Mocambique, Egypt, Kenya, Uganda, Nigeria-Sao Tome & Principe JDA, Somalia with Minister, South Africa, Seychelles, Madagascar, Morocco, Ethiopia, Senegal, Namibia, AGC (Senegal-Guinea-Bissau), Malawi, The Gambia – plus with Bid Rounds and Roadshow Announcements from:Republic of Congo, with Minister, Government Delegation and SNPC-DGH, and Republic of Gabon – plus with Government Delegations from Sonangol and Angola, Madagascar, South Sudan, Sao Tome & Principe, and many others, as well as with Speakers Africa-wide on Cameroon, Nigeria, Tanzania, Comoros, Mauritania, Sierra Leone, Liberia, Chad, Zimbabwe, India in Africa, Japan in Africa, China in Africa, Statoil in Africa, United States in Africa, Canada in Africa, and African Development Bank, IFC, TSX, JSE, and Nipex.

Sponsors

ACAS-LAW, Africa Finance Corporation, Africa Oil Corp., Africa Petroleum Corp., AirFrance / KLM, Anadarko Petroleum Corporation, Centurion LLP, Chevron, Discover Exploration, ENI, Erin Energy, ExxonMobil, GEPetrol Equatorial Guinea, GreenbergTraurig, IHC Mercedes Holdings, Impact Oil & Gas Ltd, Nedbank Capital, Noble Energy, Oando, Ophir Energy, Petroleum Agency SA, Petroleum Commission Ghana, Petrolin Group, PetroSA, PGS, Pluspetrol, Polarcus, RPS, Rystad Energy, Salama Fikira, Saldanha Bay IDC, Seplat Petroleum, Seven Energy, Shell, TMX / Toronto Stock Exchange, Tullow Oil plc, Total, Veolia, Vinson & Elkins, Woodside Energy, Wood Group PSN

Detailed Program: includes 13th Africa Independents Forum, 17th Scramble for Africa Briefing, 71st PetroAfricanus Dinner in Africa, 22nd Africa Upstream, Africa Oil & Energy Finance Forum, plus Forums on Africa Exploration Technologies, Africa Local Content, and Africa’s Young Professionals

Visit www.africa-oilweek.com

ABOUT TANZANIA PETROLEUM

Tanzania Petroleum helps you reach your goals.

CONTACT US

Dar es Salaam, Tanzania

+255655376543

info@tanzaniapetroleum.com