WILL recent natural gas discoveries help Tanzania become an economic powerhouse? The answer to this question isn’t quite simple. The gas and oil wealth will require a commitment from all the country’s stakeholders.

For a decade the government, along with international companies involved in hydrocarbons prospecting, has made a series of announcements of natural gas discoveries. These announcements have given rise to much excitement; ordinary Tanzanians are hoping for improvements in their living conditions, while the government is looking forward to billions of dollars in export revenues and foreign direct investment (FDI).

Government departments involved in the gas sector have made repeated statements of their intention to use these funds for national development. Along with this commitment the government has taken steps to improve the regulatory environment for hydrocarbons, including gas, through a review of its laws. It also commissioned a Natural Gas Master Plan for Tanzania that will outline scenarios for utilisation of the resource once production starts. Early indications are that the government is considering two options for the gas.

The first is to sell all of it in liquefied form on the international market, and the second is to use a portion of the resource for domestic gas-based industries, and export the rest. A key policy question is how to optimise the balance between the two, to meet the twin objectives of economic growth and sustainable development. The argument for general development of the gas sector hinges on the belief that it will bring in foreign revenues, create jobs and boost economic growth.

The government considers that these benefits will in turn contribute to poverty alleviation, one of Tanzania’s key priorities. Although the logic of this is understandable, given the country’s low socio-economic status, experience in many resource-rich African countries points to the fact that natural resource wealth does not per se translate into economic and human improvement.

You can also read:Tanzania extracting of gas in the Indian ocean likely to take longer

Countries such as Nigeria, Sierra Leone and the Democratic Republic of Congo, which have abundant natural resources, have been less than successful in using their endowments to make the transition from low-tomiddle- income economies, or to reach acceptable developmental indices. Pitfalls attending resource extraction have been widely documented.

The phenomenon of resource abundance existing alongside poor economic indicators, also known as the ‘resource curse’, threatens to overshadow the hopes and possibilities that come with large resource discoveries. A range of challenges associated with resource discoveries and booms has been widely ventilated.

There is a convergence of opinion that sound economic policy and law-making, a political will and governmental commitment to development, and good and transparent governance of the gas and oil sector, can do much to ensure that the exploitation of petroleum resources leads to broader economic and social development in the face of challenges that in the case of Tanzania among others include poverty, poor access to energy, limited infrastructure, unemployment and an unskilled workforce.

In the past two decades gas has emerged as a major component in the global energy mix. It is increasingly seen as an attractive fossil fuel alternative to crude oil and coal, because it is cleaner burning than either and sufficiently versatile to be used as direct domestic and industrial heating and power generation; as a direct fuel source for vehicles; and as industrial feedstock for liquid fuels and other chemical products. According to the International Energy Agency (IEA), natural gas is ‘poised to enter a golden age’.

A significant proportion of the coming gas boom will be from unconventional resources such as shale gas and coal-bed methane, provided that the social and environmental impacts associated with their extraction can be ameliorated. By 2035 gas will overtake coal as a primary energy source, to comprise 28 per cent of the global energy mix – second only to crude oil.

Similarly, it has been argued that ‘gas is the only fossil fuel set to increase its share of energy demand in the years to come’. Whereas the gas boom relies primarily on unconventional gas, conventional gas resources such as those in southern Tanzania certainly have a role to play. Currently, successive discoveries of conventional and unconventional gas resources suggest a revolution in the global energy industry may be at hand.

What this will mean for governments and national economic development depends on the governance mechanisms and management systems put in place to ensure that the resource is transformed into tangible social benefit. Whether the government will be able to keep to its objective of using gas for development, either through revenues from exports or the creation of domestic gas based industries or a combination of both, largely depends on the way in which the sector is governed.

It is too early to state with any certainty that the exploitation of this finite resource will benefit the majority of Tanzanians. Given the adoption and implementation of sound governance policies, however, together with competent and transparent administrative processes, effective, functional and independent oversight institutions and a commitment to directing profits towards socio-economic development, Tanzania can go some way to avoid the resource curse and its consequences while advancing its stated developmental goals.

Tanzania gained independence from Britain in 1961. Since then the country has been governed by Chama Cha Mapinduzi. Tanzania has had a multi-party democratic political system since 1992 and held four rounds of general elections between 1995 and 2010 . Tanzania’s economy includes services sectors (taking in transport), some manufacturing, fisheries and agriculture.

Donor aid is the single biggest contributor to the national budget. The contribution of extractive industries to the fiscal budget is, however, growing rapidly. In recent years the country has emerged as a resource haven. In addition to rich deposits of coal and natural gas Tanzania has significant deposits of heavy mineral sands; limestone; bauxite; rare earths; graphite; gold and base minerals, among others. Depending upon how they are managed, such natural resources could lift Tanzania into middle-income status.

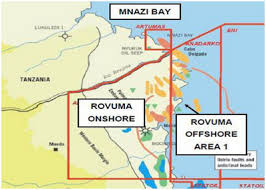

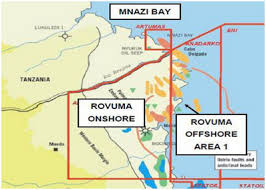

Gas has been discovered in the southern region of Mtwara. Resource extraction necessarily has an impact on the environment and for that reason achieving complete environmental balance and harmony is to all intents and purposes impossible, nevertheless all activities should aim to limit any environmental degradation that might result. This approach is already addressed in law and in environmental impact assessments: maintaining environmental integrity should not be sidelined as the resource revenues threshold draws nearer and the stakes get higher.

The government should try to allay such fears through a genuine commitment to further developing these sectors, not only because they are activities that traditionally have supported livelihoods but also because of the risks inherent in over-reliance on exports of a single natural resource commodity. Gas and liquefied natural gas production will become a dominant revenue generator in Tanzania.

The massive investment followed by the infrastructure boom will transform the southern Tanzanian provinces, allowing the local governments to get involved. Tanzanians expect that this will facilitate and attract the entry of foreign investors, exploring not only the opportunities in the energy sector, but also other areas, such as chemical, power, manufacturing and mining.