How To start Oil and Gas business in Tanzania with Zero Capital

Has happened to you?

You start from scratch, You don’t have money, you don’t have a connection.But doing business in Tanzanian oil and gas sector interest you.

You wonder how you can invest in Tanzanian gas sector? in the situation, your pocket size is too small and you have limited capitals? Right?

You feel overwhelmed!

People (Include me ) tells you there are enormous wealth in Tanzanian oil and gas sector.And you want to be thrilled with the flow of hundreds of dollars into your bank account.

But lack of capital makes you feel too down to join the league of Tanzanian oil and gas business

The situation is even worse when you hear people say oil and gas business is only for big boys having huge financial muscles. Do You lose hope?

So So So frustrated?

Don’t worry,

Lots Tanzanians faces the same struggle. when it comes to investing in Tanzanian gas sector capital is popular excuses to best of us

But.what if told you can start doing oil and gas business with little or zero capital?

what if I confidently tell you there smart way to profit with our new found wealth and become parts of natural gas boom with zero capital?

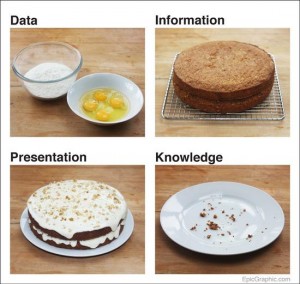

All you need is Idea, or concept material, or technology or procedure that would help in Oil and gas companies or solve specific problem in the sector.

Sound impossible? Here’s how

Oil and gas business face stiff competitions.

They compete for each other. Oil firms want to attract new clients,

They want to minimize operation costs. Also, they want to get a job done better and faster as well making the huge payoff.

However, oil companies are aware that lots average people outside there have a great ideas or new material or new procedures that would help them to address these competition and achieve specific goals.

So what they do?

They have a group that travels all over the world to look for individuals, entrepreneurs small start up business who have new ideas or material that suit them.

And they invest billions of dollars into your new ideas or concept

And the best part

These Oil firms give you money, they give you research they give you training and scientists to help your business or idea grow

Ever imagine? you run a small business you or just an entrepreneur you just have an idea and oil giant company realize your idea could impact their business.

And fund you millions of dollars to grow it . How does it sound? Sounds pretty, you move from zero to hero sometimes overnight

Read also:The Ultimate Guide to Invest in Tanzanian Oil and Gas Sector

What are the oil companies that are willing to invest into you

Example of these oil companies includes the following that support small start up entrepreneurs.Include the following

- Shell- its group called Shell technology venture

- Halliburton —–Its group called Technology R&D Group

- Baker Hughes—–its group called centers for technology and innovation

- Chevron——- its group called Chevron venture capital

- Exxon Mobil its group called :Exxon Research and Development and Exxon’s capital investment

How to tap these opportunities from this oil companies? Is all down this

Do you have ideas that will improve existing product or services in oil firms?

do you have material, procedure or technology to help oil firms to run operation smoothly and safely?

If yes feel comfortable to get in touch with one among of above mention oil companies. Or search them on google and-and tell them what you are going to offer them

I know some Tanzanian benefit from these programs and currently, they are good oil and gas companies in Tanzania

Is capital or money hinder you to invest in Tanzanian oil and gas sector?

Yes, you don’t need millions of dollars start-up capital to invest in Tanzanian oil and gas sector.What you need are interest and passion

Read:Important things you need to know to participate in Tanzanian oil and gas sector