Wildcat explorers have turned to east Africa as one of the last frontiers for oil and gas.

In the region, Tanzania and Mozambique have found large quantities of gas and Uganda has established substantial oil reserves. Kenya is now getting into the act – and exports could flow soon.

Kenya is the youngest among East Africa’s nascent resource prospects, but one of the most promising. (LON: TLW), with sometimes partner (TSX: AOI), has been the most successful wildcatter so far.

Tullow made its first discovery in Kenya in mid-2012. This came after a long time of disappointing exploration activities. And it became commercially viable after it was confirmed that there were around 300mln barrels worth of reserves.

Tullow-led joint ventures subsequently made a further six discoveries and as of January 2014, Tullow said Kenya’s Northern Basin could have an excess of 1 billion barrels of oil.

Drillers estimate the Rift Valley, which runs through Kenya from north to south, could yield 10bn barrels of oil and explorers are accelerating activities.

A connected Kenya-Uganda pipeline could pipe 500,000 barrels of oil per day (bopd).

Tullow has said Kenya could envisage exporting oil as early as 2016 and ramp up quickly to 100,000 bopd.

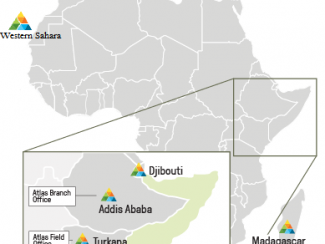

Kenya’s oil hunting grounds are parcelled out in more than 50 blocks over three main areas – offshore; along the coast reaching north towards Somalia; and in the north-western Turkana area.

Besides Tullow operators include Anadarko Petroleum (), ( and Statoil (OSX: STL) . A number of smaller groups are also involved in Kenya. They include Ophir (), (TSXV:SMB), () and the delisted .

With all this hydrocarbon activity and its buzzing ports like Mombasa, trading with the Middle East and Far East, Kenya’s consumer-driven economy has become buoyant. GDP growth this year is expected to be 5.7%.

But buoyancy can have its side-effects. In some ways Kenya has become what you might call a bottleneck economy.

The refinery in Mombasa is a case in point. Kenya has one of the largest crude oil refineries in East Africa, a 90,000-barrels-per-day (bbl/d) facility in the country’s second city. This imports and processes Murban heavy crude from Abu Dhabi and other heavy Middle-Eastern crude grades.

Most of the imported and/or domestically refined products are sold in Kenya’s major cities and the remainder is sent to neighbouring countries via trucks.

But the refinery typically operates below capacity and needs investment to realise its full potential. Part of this investment needs to be spent on de-clogging the roads.

The thousands of lorries which snarl the traffic badly effect the efficiency of the refinery. But the situation should be alleviated when the Chinese sponsored railway from Nairobi to Mombasa is completed.

Another bottleneck is the shortage of power. Kenya is in the middle of a programme to expand from 1,664 MegaWatts (MW) available in 2013 to 5,500 MW by 2017. This is to meet growing electricity demand. These projects do not come cheap. The power expansion plan is costed at US$1.83bn.

Kenya is tapping foreign investors through a hard currency sovereign bond as well as dipping into the pot of aid from multilateral donors like the World Bank and individual countries like the US (the US agreed to give Kenya US$1bn following the visit of President Barack Obama earlier this year.)

Kenya might also take a leaf out of its southern neighbour Tanzania’s book.

Like Kenya, Tanzania is an emerging economy that is actually emerging with economic growth rates that have been running at 7% a year. There is a huge demand for energy. Estimated 2016 demand from existing and new power plants is around 120mln standard cubic feet of gas a day (mmscfd). Gas demand is expected to grow to 475mmscfd by 2018.

Helping to fill this growth in demand are three small UK based oil and gas companies (), () and (LON: WRL), which are signing long-term gas sales agreements (GSAs) with the Tanzanian authorities to transport from newly built pipelines to the capital Dar es Salaam.

In the case of the /Solo grouping the deal is to move 20mmcsfd from its Kiliwani North field south of Dar es Salaam. Wentworth has separate arrangements.

Kenya is different to Tanzania in that it derives most of its energy for power stations from hydro-electric and geothermal plants. Its gas resources are not as developed as Tanzania

But that could to start to change sooner rather than later; and change in a way that could benefit small foreign groups operating in Kenya.

Back in 2010, agreed to buy Canada’s Black Marlin for US$101mln (£69m) in a deal that would have given the West Africa-focused oil explorer a significant foothold in the east of the continent and greatly increase its resource base.

Then listed on the Toronto Venture Exchange, Black Marlin operated in Kenya, Ethiopia, the Seychelles and Madagascar, with 1.2bn barrels of oil equivalent (boe) in net resources. The preponderance of these resources are thought to be in Kenya.

is now in administration and is forced to dispose of former Black Marlin assets (imminently it is thought) in what can only be called a fire sale.

Any deal for the Kenya assets is subject to government approval, but the price would almost certainly be lower than paid.

A small foreign company with the wherewithal to bring the Black Marlin assets on-stream could then possibly do a deal with the Tanzania operators and help bridge Kenya’s power gap.

This is conjecture at this stage. Nothing is written in stone in these matters. But it is an interesting idea.