New Tanzania Oil and Gas Report 2016

Energy Boardroom recently releases a new report on the Oil and Gas sector in Tanzania, ‘Inside Oil & Gas Tanzania’.

Huge 55tcf gas discoveries have turned Tanzania from what was once an oft overlooked backwater in terms of hydrocarbons investment into one of the hottest properties in global energy. Multinationals are now jostling for position to capitalize on the wealth of opportunities in the country.

The report is an authoritative and up-to-date assessment of the major sector in this strategically important oil and gas producing country. Themes covered include

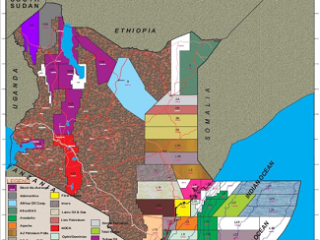

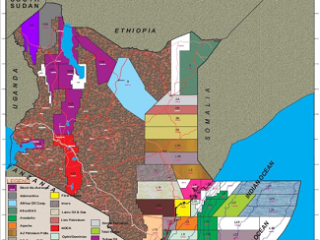

- Tanzania in East Africa

Neighboring Mozambique and Kenya also possess the potential to develop into regional energy heavyweights. We assess Tanzania’s strengths and weaknesses compared to its East African neighbors and the importance of the contract to transport landlocked Uganda’s oil to the coast.

- LNG: A Game Changer?

After years of bureaucratic delays, Tanzania is finally poised to build an LNG plant in the Southern port of Lindi and begin to capitalize on its gas reserves through export to international markets. We take a detailed look at this project and its potential to transform Tanzania.

- Regulatory Reform

2015 was a big year for Tanzanian oil and gas, with the election of President John Magufuli and the roll-out of the Tanzania Petroleum Act. We assess the impact of Magufuli’s early tenure on the industry and introduce the reformed constellation of actors created by the new legislation.

- The Big Scramble

Our in-depth cover story, ‘Braced for the Big Scramble’ examines the international oil and gas operators, large and small, making moves in Tanzanian oil and gas. We look at their respective strategies, successes, and failures, to paint a detailed picture of the opportunities in Tanzania.

Energy Boardroom‘s Tanzania Oil & Gas Report features in-depth interviews with:

- James Mataragio, TPDC

- Jamidu Katima, EWURA

- Øystein Michelsen, Statoil

- Neil Ritson, Solo Oil

- Salim Bashir, KPMG

Quotes

“We have, to date, barely explored half of the country, yet from what we have witnessed so far, the potential is absolutely enormous”

- James Mataragio, TPDC

“We are witnessing the dawn of a brave new economic trajectory for our country. There is much to be optimistic about. The future of the Tanzanian oil and gas industry is unquestionably bright!”

- Jamidu Katima, EWURA

“[The LNG plant project in Lindi] is emblematic of the dawning of a new era in East African gas and of the resolve to make Tanzania an important player in the gas space.”

- Øystein Michelsen, Statoil

“There’s a real race underway to become Africa’s newest LNG exporter and each side is on the lookout for any possible advantage they can gain.”

- Ronke Luke, Oilprice

Download

Download the report at http://www.energyboardroom.com/oil_and_gas_report/tanzania-inside-oil-gas-report and visit energyboardroom.com for up-to-date reports, news, articles, interviews, and facts and figures from a wide range of global oil and gas markets.

SOURCE Energyboardroom