Oil firm wants Tanzania favours

“We understand that the nation needs tax revenues, but I think it is counterproductive to tax operations if by taxing them, they are delayed or made more expensive.Tthe returns from operations will dwarf any revenues that the country may make from the current tax regime and it is that we should be encouraging,” Dr. David Ridge, the Chief Executive Officer of Swala Oil and Gas

Favourable changes to the PSA format can help sustain development and production activities.

Also Read:how-much-do-Tanzanians-know-about-natural-gas

Dr. Ridge advised the government to be sensitive to the difficulties faced by the exploration and production companies.

Dr Ridge said although the oil and gas sector has had a steady growth over the years, the sector had already spent a fortune in the exploration and therefore, needs some consideration especially in the payment of taxes more so for those companies that have not yet made any discoveries.

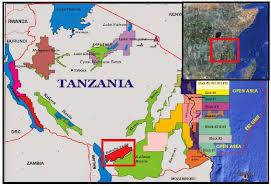

“The oil industry has so far invested over $1 billion in exploring for oil and gas in Tanzania and not made anything like that in return,” he said. A subsidiary, Swala Oil Tanzania, is presently exploring for crude on the mainland. Swala has a 50% equity in, and is operator of the Kilosa-Kilombero and Pangani licences.

He said that though he fully supported the government’s desire to encourage more investors into all sectors of the Tanzanian economy, there were already investors entrenched in the country like Swala ‘who should be looked after’ if others were to follow.

Dr Ridge said as a company listed on the Tanzanian Stock Exchange with a Tanzanian DNA, Swala desired to be treated as such over and above other ‘foreign’ companies.

The CEO also cited little or no corresponding dissemination of information about the role of oil and gas exploration companies to the public as a recipe for un-called-for public suspicions that is directed at the investors.

He said $20 billion is needed before companies can realize any commercial gains from their licenses.

He asked the government and the Tanzania Petroleum Development Authority (TPDC) to ease documentation and expedite processes, citing the current delays and the attendant red tape as the worst nightmare for the investors.

Swala is an affiliated company to Swala Energy Limited, a company in turn listed on the Australian Stock Exchange (ASX) .

Swala holds assets in the world-class East African Rift System with a total net land package in excess of 17,500 square kilometres.

New discoveries have been announced by the industry in a number of licences along this trend, including Ngamia and Twiga, which extend the multi-billion barrel Albert Graben play developed by Tullow Oil into the eastern arm of the rift.

Comments are closed.